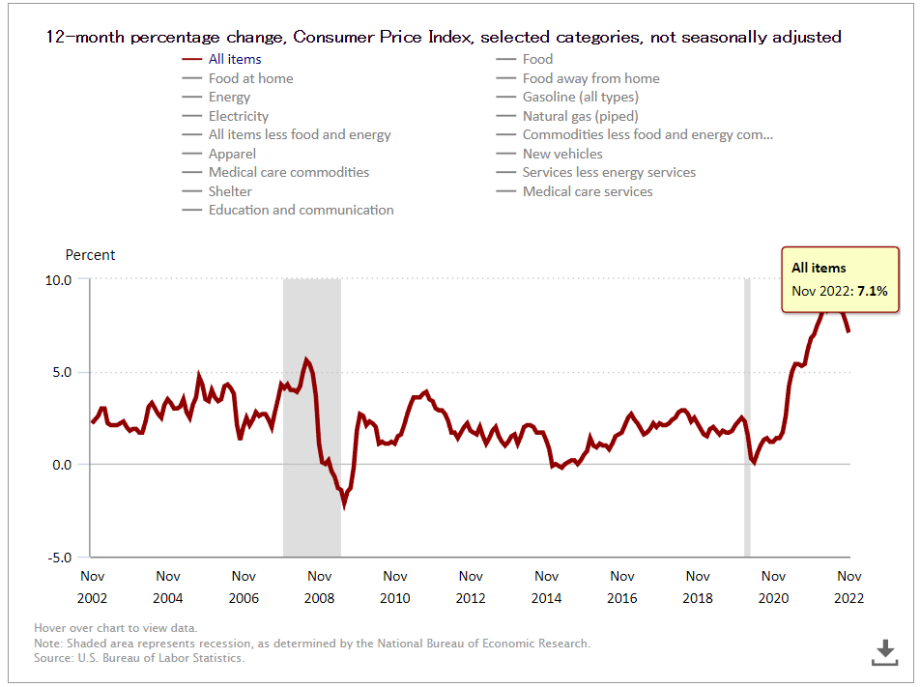

Bitcoin moves higher on CPI data

The CPI for November 2022 was released today and came in under the expectations for 7.3% at 7.1% for the last 12 months, a 0.1% increase from last month.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in November on a seasonally

adjusted basis, after increasing 0.4 percent in October, the U.S. Bureau of Labor Statistics reported

today. Over the last 12 months, the all items index increased 7.1 percent before seasonal adjustment.

The index for shelter was by far the largest contributor to the monthly all items increase, more than

offsetting decreases in energy indexes. The food index increased 0.5 percent over the month with the

food at home index also rising 0.5 percent. The energy index decreased 1.6 percent over the month as

the gasoline index, the natural gas index, and the electricity index all declined.

- U.S. Bureau of Labor Statistics

On a five-minute candlestick chart, it is clear that Bitcoin jumped substantially upon the release of the November CPI.

The CPI’s release will be the last big piece of data the Fed has to go off until February of 2023. With the report being released the likelihood of a 25-bps rate hike at next year’s meeting rose dramatically. Still, the likelihood favors a 50-bps rate hike at tomorrow’s FOMC by a weight of 79.4% to 20.6% (75 bps).

The broader markets across took off when a less pessimistic outlook for the near future that traders had already largely baked in the markets was confirmed. Both risk-on and risk-off assets had a run on today’s news that underpins a less hawkish Fed moving forward. Both cryptocurrencies and safe havens such as gold and silver had nice rallies today.

As seen in the chart above Bitcoin price rose by 1.8% or $317 in the 5 minutes surrounding the release of November's CPI numbers, and in fact, made its high for the day in that same window of time just above $18,000. In the time since then, Bitcoin has given up most of the gains achieved upon the release of the November data. Approximately 4 hours and 25 minutes after the CPI was released (8:30 AM ET) at 12:55 AM ET Bitcoin would retest the price of $17,615 and moved steadily higher from there. Bitcoin’s price as of 3:38 PM ET is $17,748 representing a gain of 3.13% or $540.

Bitcoin still has to contend with the resistance of both the long-term 78% retracement and the 50-day SMA which Bitcoin traded above briefly today but quickly fell back beneath and currently is making an attempt to move back above these levels but seems poised to close below them.

The resistance that is represented by the long-term 78% retracement at $17,798 should not be understated in its importance being the price that once was Bitcoin’s all-time low since hitting its record highs in November 2021 up until November 2022 when on November 9th the low of $15,512 was reached. Although it is too early to decisively call the low at $15,512 a bottom, I believe we are “close” to a bottom with our estimates remaining the same for over a year now for Bitcoins bottom to fall between $14,000 – and $17,000 and the next bull run to start in Spring of 2023.