Conflict causes cryptos to fly as many flee fiat

The turmoil in Ukraine has caused many citizens in the countries involved (Russia, Ukraine) to flee traditional fiat currencies and turn to Bitcoin and other cryptocurrencies, namely stable coins such as USDT. The reasons behind the flight from cash are two-fold.

The first is that ATMs are either out of cash or out of order in cities across Ukraine. This is a common occurrence in any region where there is active warfare, or political power has been taken by force. One recent example is when the U.S. withdrew from Afghanistan. The banks simply did not have enough cash on hand to issue to the thousands of people wishing to withdraw their savings in preparation for the inevitable Taliban takeover. citizens attempted to safeguard their savings from being confiscated by the brutal regime or simply to get out of the country entirely.

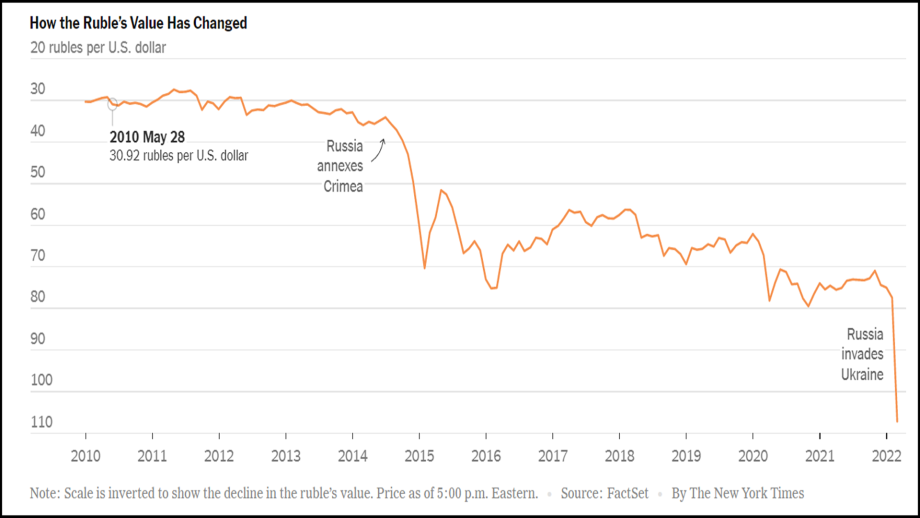

Second is the realistic fears that their native currency will face severe devaluation once the country’s GDP quickly dissipates if the factories once producing goods to be sold transform into factories producing armaments for the war effort. This is especially relevant to Russians as the Rubel swiftly fell to equal less than $0.01 at the time of writing.

Refusing the call from Ukraine’s vice prime minister asking cryptocurrency exchanges to block all Russian user accounts. They were met with oposition on the basis that the Russian citizens are innocent victims of their leader’s blind sightedness. One of the largest exchanges, Binance, told fortune magazine, “We are not going to unilaterally freeze millions of innocent users’ accounts,” and “Crypto is meant to provide greater financial freedom for people across the globe. Binance did state that they will block accounts of Russians that have been hit with sanctions but that they won’t unilaterally freeze accounts of all Russian users. To unilaterally decide to ban people’s access to their crypto would fly in the face of the reason why crypto exists.” Binance is not ignoring the crisis vowing to donate at least $10 million to humanitarian efforts in the region.

Kraken CEO Jesse Powell went one step further, “Our mission at [Kraken] is to bridge individual humans out of the legacy financial system and bring them into the world of crypto, where arbitrary lines on maps no longer matter, where they don’t have to worry about being caught in broad, indiscriminate wealth confiscation,” he wrote. “Our mission is better served by focusing on individual needs above those of any government or political faction…Besides, if we were going to voluntarily freeze financial accounts of residents of countries unjustly attacking and provoking violence around the world, Step 1 would be to freeze all U.S. accounts. As a practical matter, that’s not really a viable business option for us.”

These fundamental tailwinds have boosted the bullish sentiment for Bitcoin, so what are the technical forces behind these moves? Well, as we spoke about yesterday, Bitcoin opened at the 78% support level ($37,500) and traded all the way to the next Fibonacci level at $44,275 before backing off slightly. In doing so, we broke through the 50-day moving average yesterday, and today intra-day highs touched upon the 100-day moving average currently sitting at $45,000. A break above the resistance at $44k-$45k seems probable at this point if and when this does occur. The next area of major resistance comes in at $49,000 which represents the 50% retracement and the 200-day moving average.

Possibly the most encouraging aspect of the rally underway is that Bitcoin broke its correlation with major indexes yesterday. The connection between the Nasdaq and Bitcoin was possibly the biggest risk factor to cryptocurrencies as a whole.

The index, which has been moving higher with few dips for the past decade hit its all-time high above 16,000 in November, only days apart from Bitcoin’s all-time high. Since that point both the Nasdaq and Bitcoin have been on the decline and with the ratcheting up of interest rates needed to fight inflation the major indexes are likely to remain on a downward trajectory. If Bitcoin can continue to make its own path decoupled from U.S. equities it would be very bullish indeed akin to dodging a bullet.