Is a Crypto Winter on the way?

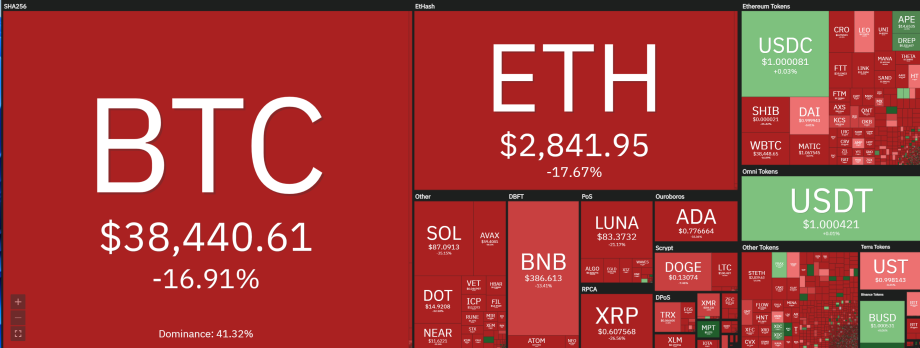

Although we did see Bitcoin and other cryptocurrencies gain value today, the overall trend has been to the downside for the entire sector. Bitcoin is trading up by about 1.5% on the day but down 2.5% from a week ago and lower by nearly 17% compared to a month ago.

It is no secret that Bitcoin and nearly every other crypto has been in a defined bear market, but I think most believe that we will see a turnaround sometime shortly. But I will explain why I believe that there may not be any huge rally in BTC for a long time. Going back to the halving cycles and the fact that we have just hit the midway point for this four-year pattern, let us compare how BTC was trading exactly four years ago.

MAY 1ST 2018

On May 1st, 2018, Bitcoin was trading at around $9,200 after coming down from its all-time high of nearly $20,000 in December of 2017, five months earlier. It took BTC over one year before it would regain the price point of $9,000. Those five months were miserable. Bitcoin practically free fell from the ATH to $6,000 before having a slight recovery to where it was on May 1st, at $9,200, a 50% drop in price in five months, and it was destined to go lower.

May 1st, 2022

Yesterday was May 1st, precisely four years ago, and since hitting a new all-time high at around $70,000, we have lost 50% in value. The decline was a basic free fall and did include a slight recovery before continuing lower, just like four years ago.

Winter on the way?

Since the start of 2022, Bitcoin and the Nasdaq composite have moved nearly in tandem. In fact, they both show a decline of approximately 17%-19% from the start of the year. The macro picture and larger fundamentals aren’t in favor of a turnaround in the tech-heavy index. Rather they support a further decline. To simplify my thoughts, I would say that we will see a period of stagnation or further decline of both the Nasdaq and Bitcoin. The Nasdaq correlation has the potential to turn the weather into a cold and even long crypto winter.