High Inflation Causes Sell-Off

The CPI (consumer price index) numbers came in for January, showing a sizeable increase year over year compared to last month. It came in over analysts’ expectations, predicting a 0.2% – 0.3% increase coming in at a staggering 7.5%—this a half of a percent increase over December’s numbers. So not only are we looking at a 40-year high, but it continues to rise even still.

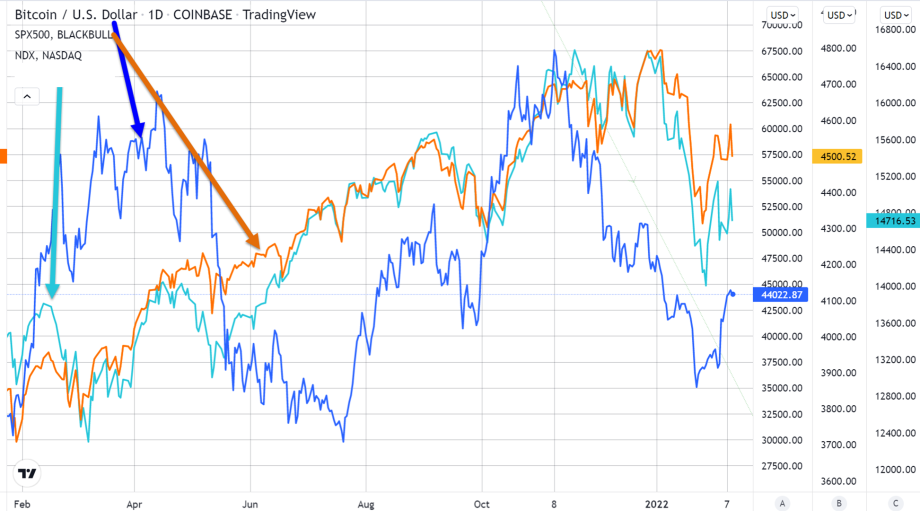

This brought the major U.S. indexes lower on the day. The S&P 500 gave up 1.9% and the Nasdaq down 2.29% on the day. As much as Bitcoin has tried to make its own path it still follows closely to the moves seen across the indexes, especially the Nasdaq composite.

Currently, Bitcoin is still hovering above $44,000 and has yet to come down all that much compared to yesterday. However, Bitcoin tends to lead or lag at different times compared to U.S. equities so we still may very well see a pullback taking the price of Bitcoin back below $44k. Support would come in at $40k should this occur which is very likely at this point. However, if Bitcoin can somehow buck the trend and hold above the $44k level, it would show a decoupling from the indexes it would certainly be very bullish for the digital currency.