Recent action points to a temporary bottom in BTC has been hit

Over the last few weeks, we have been hesitant to label the low at $17,585 reached on June 18th as the bottom for Bitcoin’s price. We did however conclude that all the criteria for a BTC bottom had been met. During this week there have been enough benchmarks reached to give us the confidence to say that BTC almost certainly has seen a bottom and the low of June 18th might be the lowest price we will see for some time.

First, I want to go back over what technical indications were already hinting at a bottom, and then cover what happened this week to have us convinced that the low hit in June will remain as the lowest price and we likely will not see a lower low come in for some time.

The major benchmark that was hit on June 18th was cited in my article “Bitcoin’s Three Unbreakable Truths” published back in February, “The third trait passed on through each of these landmark moves is that prices retraced at minimum 78% of the move to the upside following these historic rallies.” The 78% retracement we are referring to came in at $17,770. Although this level was only hit on an intra-day basis it matched up to the only other parabolic cycle that also retraced just to the 78% retracement and only touched upon it briefly. I am referring to the week of April 15th, 2013, which followed the rally from just over $2 up to a high of $267 which was reached in April 2013 also.

However, this rally in 2013 which we are labeling as the second parabolic rally in Bitcoin’s history and was the only time that the bottom at the 78% retracement level was later breached.

For that reason, among others, we are saying that the low hit in June will be the low for some time and not forever. In other words, the most likely scenario will have Bitcoin continue to rally or at least hold above $17,770 for anywhere from a few months to a year before breaching that price point. This coincides with the call we made on June 28th when we forecasted a bottom in BTC around $14,000 to be hit sometime between September and December 2023. Between now and then Bitcoin will likely hit $30,000 with a lot of sideways trading between that price and the 78% retracement ($17,770).

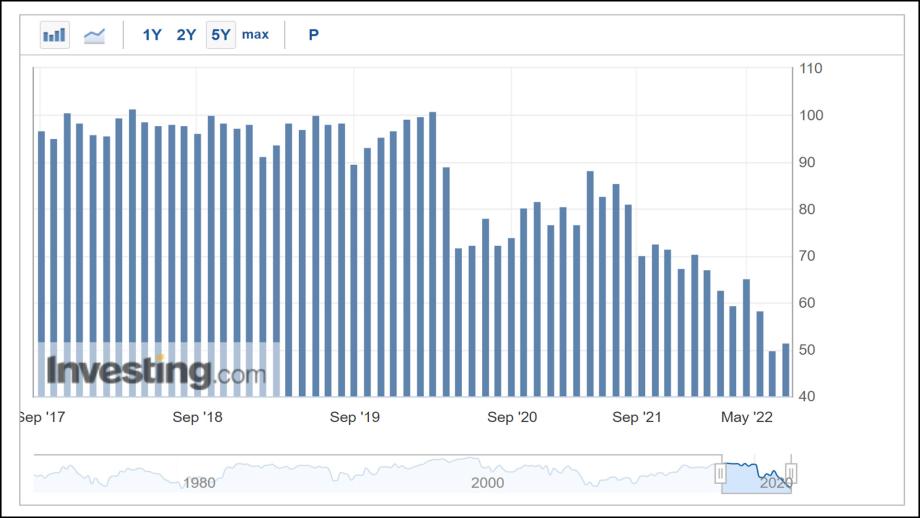

So, what changed our minds this week that a lower low is not going to occur for a while, and in the meantime, we can expect this short-term rally to continue? For one, the recent rally witnessed in U.S. equities despite inflationary pressures continuing to rise, surely our readers are aware of Bitcoin’s strong correlation to equities and the fact that consumer confidence is rising as reported today by the University of Michigan Consumer Sentiment Index which showed an uptick in consumer confidence for the first time since May that the numbers came in above expectations. Forecasts were for the survey to come in at 51.1 but the actual numbers came in at 51.5. This is the first increase since October 2021 and is showing that sentiment is somewhat out of touch with the reality that today’s PCE report revealed which was yet another spike higher surpassing forecasts from the Wallstreet journal and other financial analysts. Regardless of the uptick consumer confidence as measured by U of M is still at the lowest level not seen in the past five years.

We took out the 50-day moving average this week Wednesday. But by far the most convincing indication that BTC has exited its bear market is these weeks' move back above the 200-week SMA. Bitcoin has only traded below this moving average four times in history including this most recent incident that began on the week we hit our low at the 78% retracement. All of these occurrences lasted as long as a single week to the recent dip below the 200-week SMA which lasted around six weeks. This makes this week’s close above this important indicator the longest time spent below the technical benchmark. This week’s close above the 200-week SMA by over $1,000 is a strong indication that the bear market has at least paused if not concluded.

We also moved above the 50-day SMA and well into the clouds on the Ichimoku cloud’s analysis. The last time we were in the clouds was on April 21st when pricing was above $40,000. Currently, BTC is just $1,000 away from moving above the clouds which strengthen the case for higher pricing ahead.

Also, trading volume has remained elevated since the low hit on June 18th which means that traders that had left the BTC markets have re-entered because they also are seeing the last Month and a half as a good entry point.