Bitcoin breaks support as the U.S. dollar continues higher

The Final Countdown

As the U.S. approaches the X date, the day in which the United States government reaches its debt limit and is unable to service its debts. According to Treasury Secretary Janet Yellen, this unthinkable event is less than 10 days away. “I indicated in my last letter to Congress that we expect to be unable to pay all of our bills in early June and possibly as soon as June 1. And I will continue to update Congress, but I certainly haven’t changed my assessment. So I think that that’s a hard deadline,” Yellen said during an interview on NBC’s “Meet the Press.”

With bonds being bid to very high levels it seems buyers are playing a game of buy the rumor, sell the fact as it pertains to a US national default this has led to the dollar gaining value day after day. The odds of a default vary depending on who you ask according to analysts at Deutsche Bank the odds are only 2% this is in line with most analysts who see default as the least likely outcome however no one is calling for a 0% chance and some such as Mark Zandi, the chief economist at Moody's Analytics, forecasts a 10% chance the U.S. will breach the debt limit. Registered voters are even more pessimistic, with 17% thinking it is very likely the U.S. will default on its debt, according to a survey by Morning Consult.

Debt Ceiling's Effect on BTC

The partisan nitpicking has had little to no influence over the price of Bitcoin yet and pundits are as divided as their Washington counterparts as to how a default by the world’s top economy would impact the top cryptocurrency. I have no crystal ball in which to tell how this unprecedented incident would influence the burgeoning crypto industry as it still has strong a correlation with the broader U.S. economy and the amount of liquid capital Americans have to invest as proposed by Arthur Hayes.

To anyone unfamiliar with Hayes’s witty and concise dives into the psychological, sociological, technical, and economical drivers of the crypto industry that are so deep they make epiphanies from your first LSD trip seem as shallow as a relationship made during a season of “The flavor of love” or “The Jersey Shore.” Anyone who has yet to discover his mastery of putting the big picture into a frame small enough for us mere mortals to view I HIGHLY recommend you to check him out and decide for yourself.

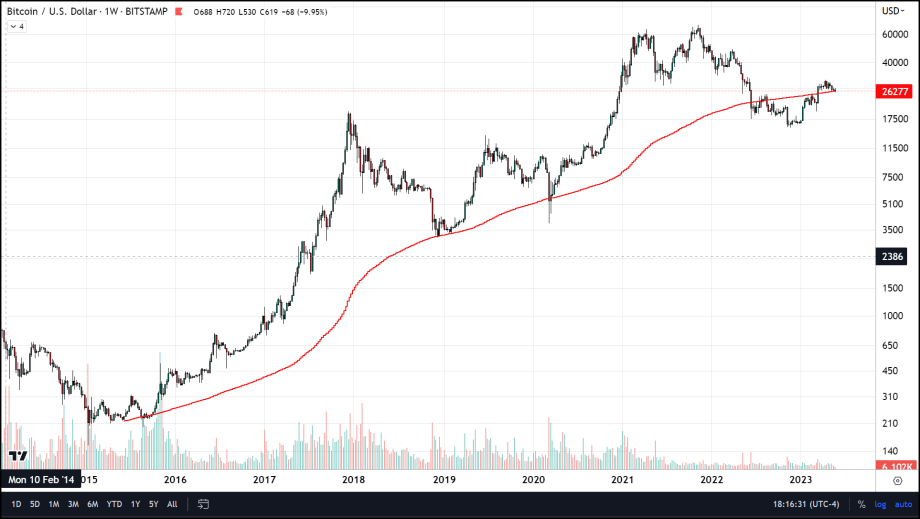

Up until yesterday, the recent surge in dollar strength has had only a mild negative influence on Bitcoin, which changed yesterday when BTC fell beneath two key support levels. Bitcoin has held onto support at its short-term 61.8% Fibonacci retracement that resides at $26,655 since surging past this historically significant price point on March 17th. For the last two months, BTC did have intraday dips below support around the mid $26,000's but was able to regain footing and close above it on every instance until yesterday's 3.31% decline, decline also took pricing beneath Bitcoin’s 100-day simple moving average. BTC has held above the 100-day SMA since January when Bitcoin began the rally that took it from its recent bottom at nearly three-year lows.

BTC Must Hold This Level

The last technical indicator that portrays a bullish narrative is the 200-week simple moving average. This moving average has a history of signaling long-term price bottoms in Bitcoin. It has successfully marked historical local bottoms in 2015, 2018, and 2020. In June of last year (2022), Bitcoin had its first extended break below the 200-week SMA. The move back above this level was a strong indication of the low being already made in BTC and if this last technically bullish study were to falter it would be hard to make a bullish case for the asset.