Bitcoin dips as the US Gov. moves 825 BTC

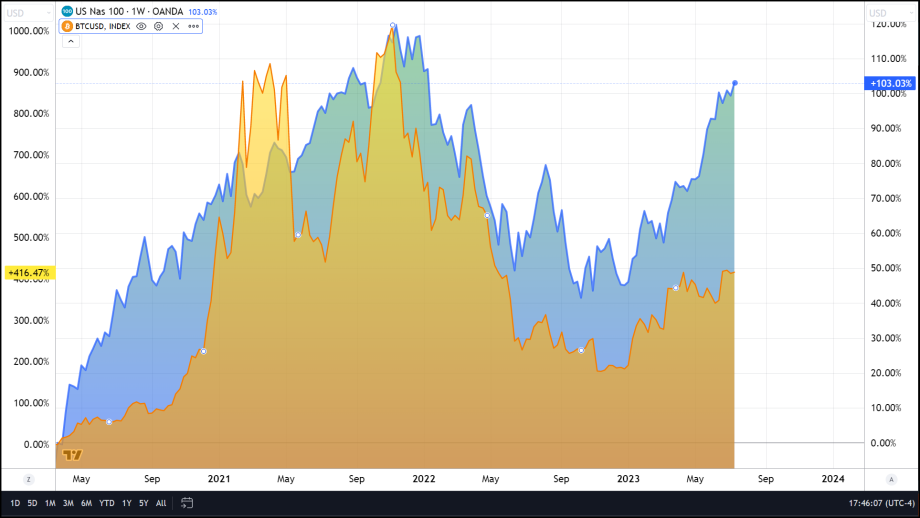

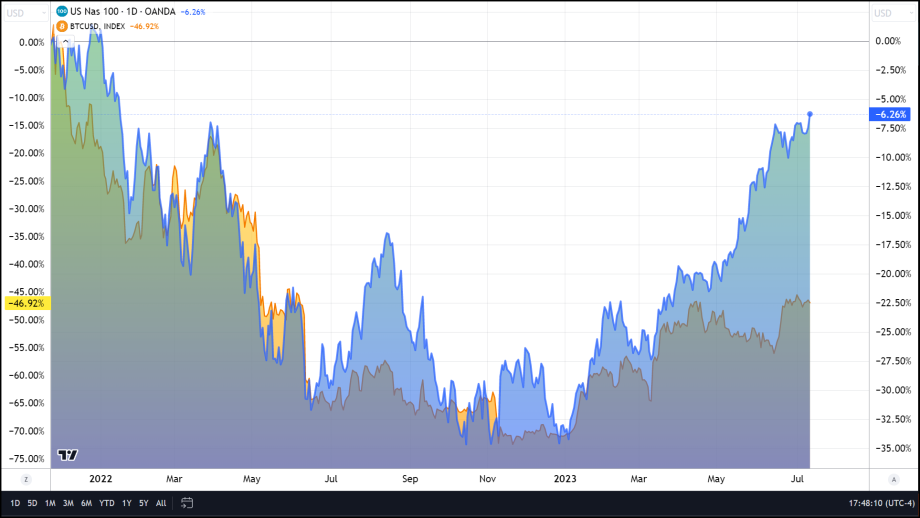

After the CPI data came out showing lower than expected inflation numbers one would assume that a bounce in Bitcoin was warranted. However, unlike other assets like the like gold and silver as well as markets such as the Nasdaq 100, Bitcoin did not join in the widespread market bump. Bitcoin tends to follow the Nasdaq 100 in direction but exhibit more drastic moves to the upside and downside, that didn’t happen yesterday.

The dollar dropped to a 3-month low at 100.50 forming a triple bottom from the current price and lows reached in February and April. The next areas of support for the dollar index reside at 99.5 and 97.7.

This should also have provided bullish tailwinds to the largest cryptocurrency but instead we saw a moderate downturn.

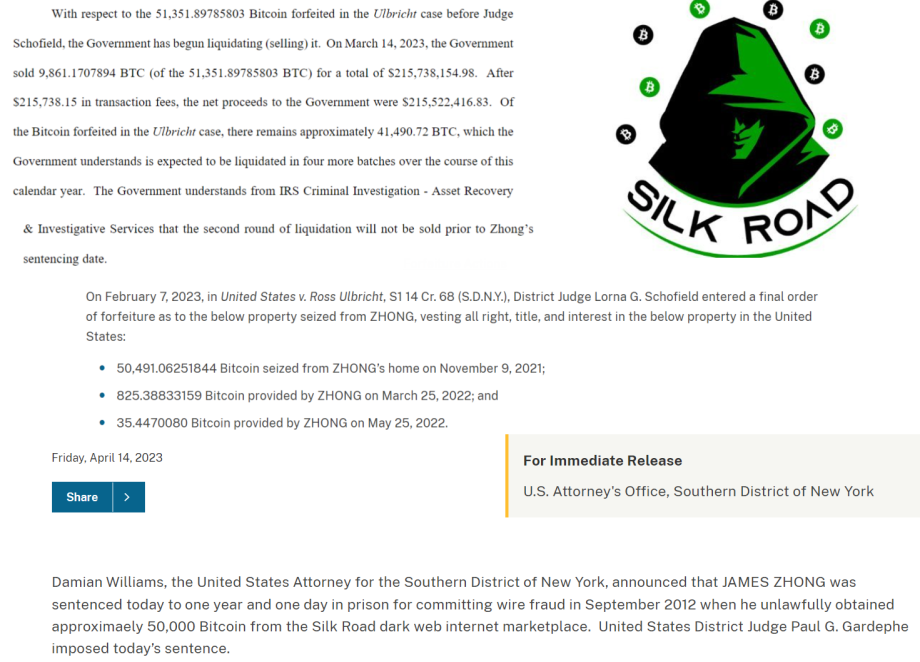

The price is starting to recover though as cooler heads prevail. The decline in BTC is likely tied to the US Government moving 825 Bitcoin tied to the Silk Road hack. This is not the first time the US Department of Justice has moved (possibly to an exchange) BTC that had belonged to the hacker to James Zhong.

The Department of Justice notably moved 13,000 BTC back in March which did have a bearish effect on the markets although they recovered relatively quick.

Seeing as the recent move was of less than 1,000 Bitcoin it should not provide any long-lasting headwinds for the asset which is somewhat evident in the recovery that started at 4:00 PM EST, BTC is now as of 7:00 AM EST almost made a full recovery from yesterday’s mild drawdown.