Bitcoin reaches highest price in over fourteen months

Moving on positive developments regarding BlackRock’s Ishares spot Bitcoin ETF, Bitcoin hit a high not seen since June 1, 2022. After opening above $30,000 for the first time since July 23, Bitcoin has so far reached $31,900 (6:15 EST) and shows no sign of slowing down. Already the equates to a 6.23% price increase ($1,868) and has a good chance of topping $32,000 before the session ends.

We sent out a trade alert calling for subscribers to go long.

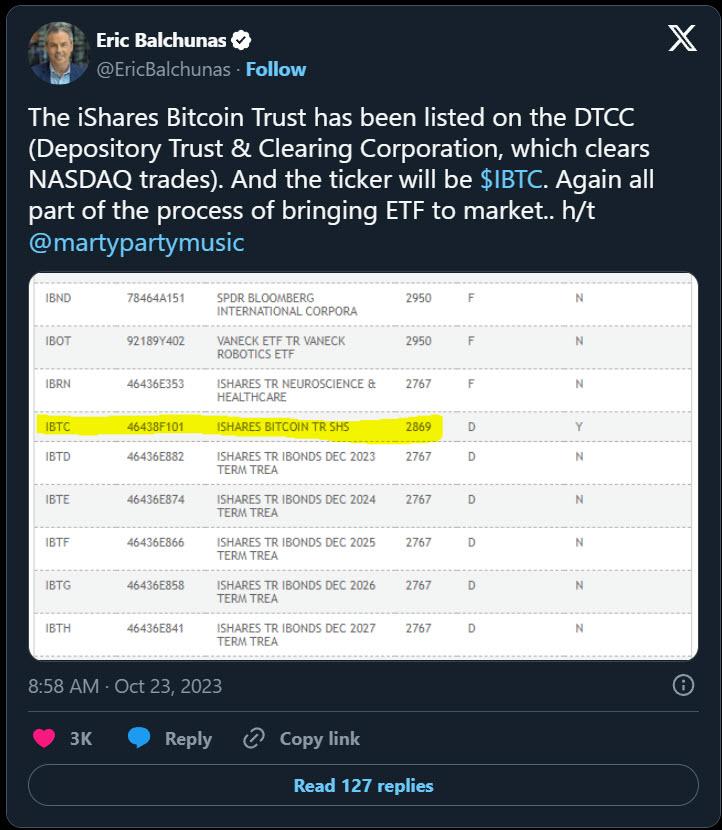

The news that helped propel BTC to its highest price this year is more evidence that BlackRock’s Ishares spot ETF is as good as approved, if it has not been already. According to an article published on The Block “BlackRock's highly anticipated spot bitcoin ETF, the iShares Bitcoin Trust, has made an appearance on a list maintained by the Depository Trust and Clearing Corporation, which Nasdaq says provides post-trade clearance, settlement, custody and information services.”

"This is first spot ETF listed on DTCC, none of the others on there (yet)," Bloomberg senior ETF analyst Eric Balchunas wrote in a thread on X. "Def notable BlackRock is leading charge on these logistics (seeding, ticker, dtcc) that tend to happen just prior to launch. Hard not to view this as them getting signal that approval is certain/imminent."

If or when BlackRock’s ETF is cleared, it will be listed under the ticker symbol $IBTC. More positive ETF developments came today with The U.S. Court of Appeals for the D.C. Circuit issuing a formal mandate for Grayscale’s spot ETF to be reconsidered and that while the SEC could deny the application for other reasons, they cannot deny the approval on the basis of “price manipulation”. If Grayscale gets approved to convert its Bitcoin trust into an ETF, the ticker symbol will remain the same and be listed on NYSE Arca under the symbol GBTC.

Traders are viewing this recent development as a last call to enter BTC before the rally that will surely follow an official announcement of a spot ETF.