Why the crackdown on Binance and Coinbase may eventually benefit BTC

Why the crackdown on Binance and Coinbase may eventually benefit BTC

Gary Gensler’s SEC has filed lawsuits against two of the biggest centralized cryptocurrency exchanges operating in the US. The Securities Exchange Commission claims that both Binance and Coinbase are guilty of securities violations. The allegations center around the sale of certain coins that the SEC is now calling securities. This list of coins that has been deemed securities has grown significantly and without any prior notice of these coins being labeled as such was given by the commission. The list really started in December 2020 when the SEC charged Ripple Labs with the sale of XRP equating to the sale of an unregistered securities offering in the US dating back to 2013. More recently after the 2021 appointment of Gary Gensler to head the SEC, they have taken a much more aggressive and hostile stance.

The lumping of crypto assets started to accelerate after the collapse of Terraform Labs in February, the list included Terra Luna Classic (LUNC), Terra Classic USD (USTC), Mirror Protocol (MIR), and 13 mirrored assets that attempted to mirror the movement of big cap tech stocks. Then in April the SEC charged Bittrex with operating an unregistered national securities exchange and added six more coins to the growing list of tokens deemed securities adding OMG, Dash, Algorand, Monolith, Naga, and IHT.

However other than Ripple (XRP) and Dash to some extent the coins that were named were not advancing the crypto industry in any real way and therefore did not slow down the development of the industry in the US. However, with these most recent allegations against Coinbase and Binance some of the coins named are major players in the field and represent both a huge market cap as well as chains being heavily developed and utilized. The coins I am referring to include BNB, Solana (SOL), Cardano (ADA), Polygon (MATIC), and SAND.

All the coins listed in the Coinbase and/or Binance lawsuit were trading down by an average of 4% yesterday on June 14th at 6:20 EST. Solana, which was one of the most hi tech layer one blockchains that had a lot of promise especially in the past and boasted more developers than most other blockchains. SOL is down approximately 30% since the June 5th announcement of charges against Binance in which Solana was listed as a security by the SEC.

Cardano also declined by 30% in such a brief window of time. The once #3 crypto’s market cap went from $12bn to $9bn in less than 10 days. At its peak in September 2021, Cardano’s market cap was almost $100bn (billion), do the math and that equals a market capitalization that is down 89% in less than two years.

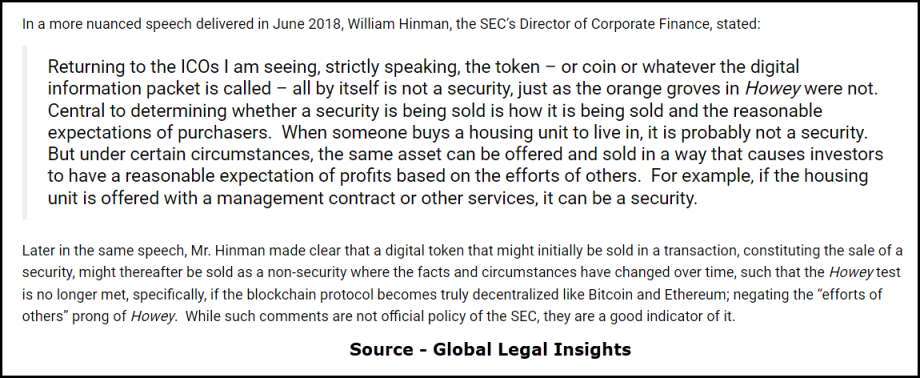

This carnage in the crypto space at first excluded the top two coins Bitcoin and Ethereum as they are seen as safe from being deemed as securities from a speech made by the SEC’s director of Corporate Finance e (William Hinman) in 2018.

Then SEC Chair Gary Gensler himself stated that “everything other than Bitcoin” is a security that falls under the agency’s remit. This is why I believe that these rulings could benefit Bitcoin in the long run. However, there is surely going to be some major damage done in the short term even to the #1 oldest, biggest, and arguably most stable crypto BTC. This is supported by Bitcoin’s market dominance which has grown by nearly 3% in the last 9 days.

Still, BTC has broken below the resistance we labeled as critical on Monday. As such we are issuing a sell order on BTC. With our first price target being the 61.8% Fib. retracement at around $24,000 and then the 200-day SMA, currently at $23,687.