Bitcoin pumps and dumps on ETF now seems poised to correct

Bitcoin experienced 2 hour-long pumps that were followed by immediate crashes to $45,600 over the past week days. Both occurred following approval of the multiple spot Bitcoin ETFs, with decision deadlines set for January 10th. The difference was one was a legitimate announcement, while the other was the result of the SEC’s official Twitter (X) handle, @SECGov, succumbing to a SIM swap attack.

The SEC gets pwned

In these attacks, a malicious actor would simply gain knowledge of the phone number associated with @SECGov. Subsequently, they likely executed a sophisticated SIM swap attack by exploiting vulnerabilities within the cellular provider's system. This likely involved manipulating authentication protocols to gain unauthorized access to the targeted phone number.

Twitter reported that the SEC’s account did not even have 2FA activated, which a big failure on their part. Although if the type of 2FA enabled allows for SMS authentication and does not require an encryption-based verification app such as google authenticator, it would still be vulnerable to these forms of attacks.

Buy the hack sell the fact

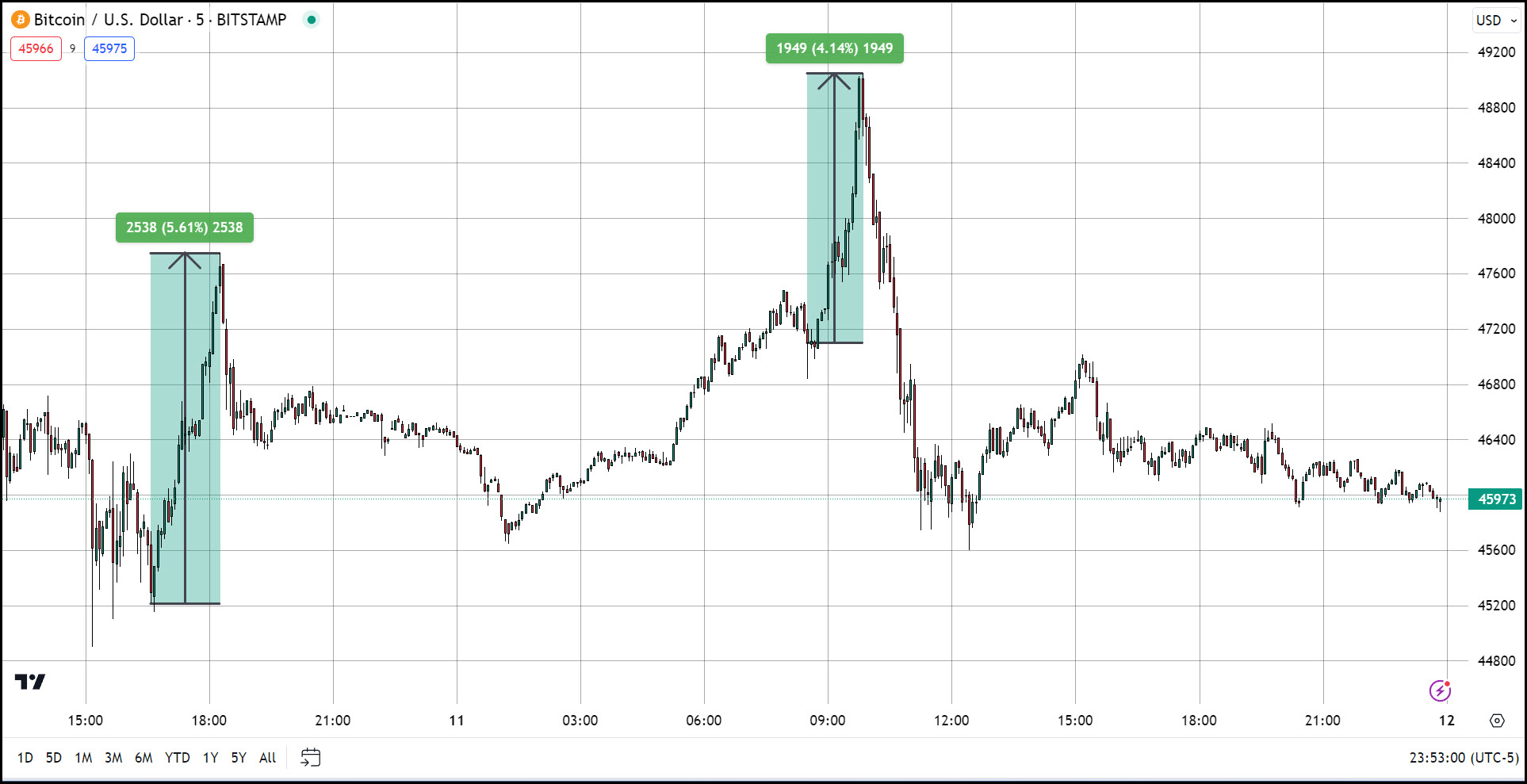

The interesting thing was that although the false report was debunked within minutes by Gary Gensler on X and the SEC regaining control within about 30 minutes. The move Bitcoin received was greater than the move it made the following day when the actual announcement was made. Both rallies from the approvals (real and fake) took Bitcoin substantially higher in about an hour’s time before hitting an apex and correcting swiftly. However, the fake approval catalyzed a greater price move of approximately $2,540 compared to the $1,950 gain that resulted from factual announcement the following day.

Both moves fit the description of your typical crypto pump and dump usually associated with far lesser coins than BTC. In both subsequent dumps Bitcoin made lows just around $45,600. However, the dump following the official approval was much steeper than the fake one that occurred the previous day.

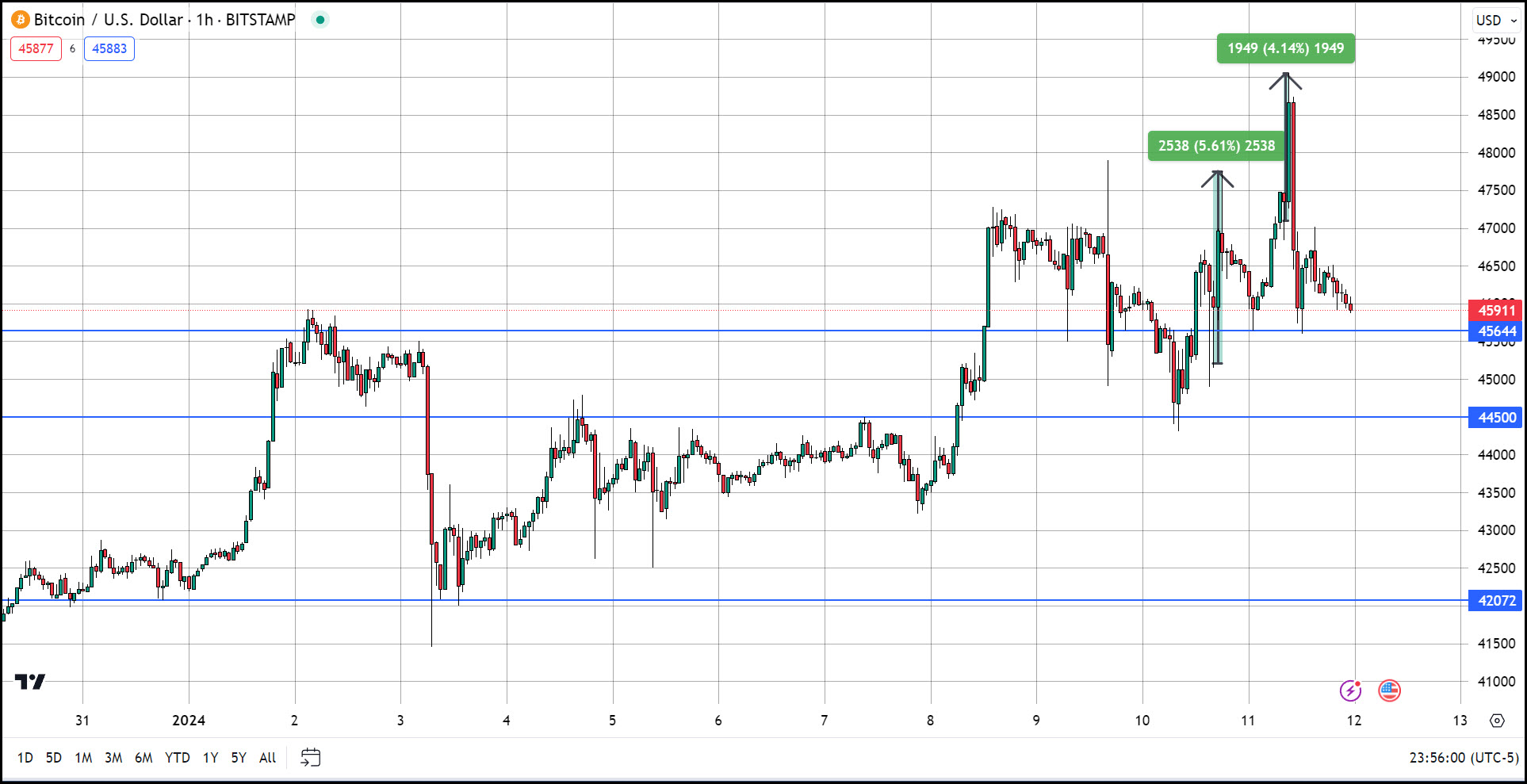

Now after the ETF euphoria has ceased leaving only the melancholy market sentiment coming down from its high, Bitcoin seems poised to move lower before making another play higher around the time of the next reward halving (April).

Next levels of support

Bitcoin’s first level of support is the price point it fell to following both pumps mentioned above and again at 4:00 AM ET, $45,600. Whether this level breaks before this article is published is up in the air in my opinion, but it does match up also with the highs seen on January 2nd so we will see how well the article ages overnight (Author in Hawaii).

If, or more likely when this price point fails the next levels of support are at $44,500 and $42,000.

Traders who have been taking our calls its time to cash out

For traders who have been taking our trade recommendations and are long from either $31,500, $38,200 or both. Now is the time to move protective stops from $36,500 up to $44,000 to lock in a nice hefty profit.

Traders could also choose to sell their positions at the market. I feel the ETF trade was a no-brainer opportunity and I feel we executed it well. I hope some of my followers took our advice and if you didn't don't worry while this particular move may be over there should be a good buying opportunity over the next few months to capitalize on the April halving event, so make sure you subscribe to Thegoldforecast.com/crypto so you will be able to view our trade recommendations as well as our bi-weekly articles.