BTC’s 3 Truths Remain Unbroken

“We are in the midst of the fifth of these parabolic cycles. The first rule has already been met when in December 2020, we traded above the previous record high ($20,00), and the monthly candle doubled in size. However, the final two characteristics point to the possibility that Bitcoin has yet to fully correct from the current record high in the market. For these constants to continue to hold the truth they held since Bitcoin’s emergence into our world, both financially and philosophically, we would expect to see the current correction that has been underway for over three months to conclude at a price no higher than $18,000 and no lower than $3,000.” - Excerpt from “Bitcoin’s Three Unbreakable Truths” published February 22nd of this year.

My point for the excerpt above is to underline the fact that Bitcoin has been historically and recently following a very predictable pattern and also that Bitcoin has hit the minimum retracement level “technically speaking” and therefore could have made its bottom on June 18th when it made a low of $17,600. But more importantly, that would be the most optimistic case for Bitcoin, and in no way does it signal the bear market is over, simply it has met the minimum retracement to continue to complete the fifth cycle of a pattern that has existed since its inception.

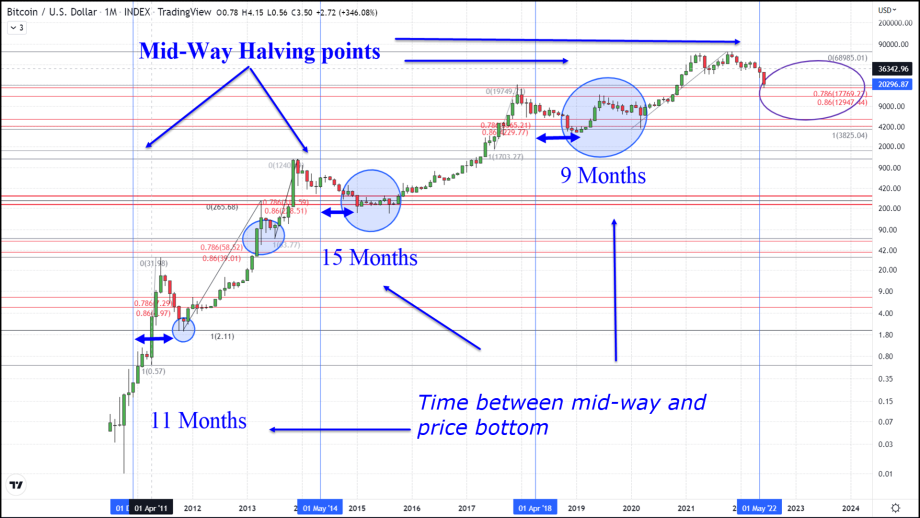

From looking at the previous four cycles we can glean some hints at how long Bitcoin will remain near its bottom before entering the next bull market. All of the previous cycles except for one hit their bottoms anywhere from nine to fifteen months following the mid-halving date. We have just made it two months past the most recent mid-halving date, from this data we can estimate that we have another seven months before we would typically see our true bottom.

Another aspect of the four previous cycle bottoms is that each time BTC spent more time trading and consolidating near its bottom before rallying. This trait of Bitcoin’s parabolic cycles also suggests that we are at least six months away from exiting a bear market that has further to fall or a sideways market that continues to consolidate at best.

One last aspect of the last four cycles, particularly the three that occurred around one year after a mid-halving point, as our current cycle appears to be that we can use to hint at where BTC finds its bottom at if indeed it does head lower is how each of these three cycles retraced a little bit less than the previous. For instance, in the first cycle, Bitcoin retraced 95%, in the third cycle Bitcoin retraced 92% and in the fourth cycle, it retraced 86%. If this indeed is a pattern that continues, we would see a retracement of less than 86%, which is at roughly $13,000. As such I am calling for $14,000 as a likely bottom, which was the highest monthly close before November 2021.